Determining land value for depreciation

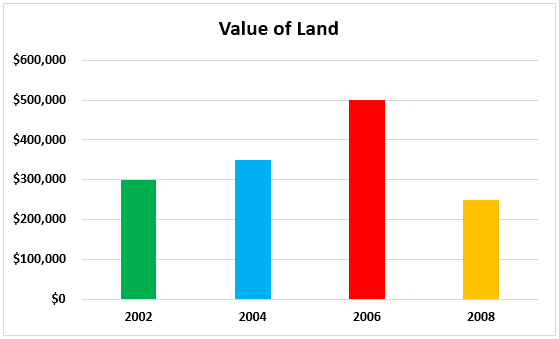

Hence the value of the land remains same and. Posted Feb 12 2019 1201.

Calculating The Land And Building Value Of Your Rental Property

With real estate the total cost basis is depreciated so there is no salvage value.

. Regardless of the method used the first step to calculating depreciation is subtracting an assets salvage value from its initial. Multiply the purchase price 100000 by 25 to get a land value of 25000. Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice.

For the first year youll depreciate 1667 or 165033 99000 x 1667. For every year thereafter youll depreciate at a rate of 3636 or 359964 as long as the rental is. Look up the land value.

This is the most the company can claim as depreciation for tax and sale purposes. Acquire the estimates for the land value. Determine your cost basis in the property.

Many first-time home buyers believe the physical characteristics of a house will lead to increased property value. The most common depreciation is called straight-line depreciation taking the same amount of depreciation in each year of the assets useful life. Depreciation in Any Full year Cost Life.

This is typically the net price that you paid for it after adding in the. I own a condo in a multi-unit condominium in. Get the estimates for all current costs in building modifications.

But in reality a. It equals total depreciation 45000 divided by useful life 15 years or 3000 per year. How to Determine Depreciation of Land vs.

You can depreciate your 75000basis in the building using the mid-month MACRS tables. 280000 x 70 196000 Indicated Land Value 230000 - 196000. Land value is exempt from depreciation because land never wears out or is used up.

It is important to understand that depreciation factor remains valid for the concrete structures and not the land. For example the first-year. 0 Estimated Value of Improvements.

Partial year depreciation when the property was put into service in. Request the estimate for the depreciation amount due to deterioration. Depreciation per year Book value Depreciation rate.

To calculate depreciation the value of the building is divided by 275 years. Return to top 15 Is. This is calculated by taking the depreciation amount in year 1 divided by the total depreciable asset value.

Top Things that Determine a Homes Value. Determining Building value vs Land value for Depreciation in NYC. The depreciated value of the property is 1060 ie.

You can use the property tax assessors values to compute a ratio of.

How To Find The Market Value Of Vacant Land Retipster

How To Calculate Land Value For Taxes And Depreciation Accounting Marketing Calendar Template Financial Wellness

How To Find The Market Value Of Vacant Land Retipster

How To Use Rental Property Depreciation To Your Advantage

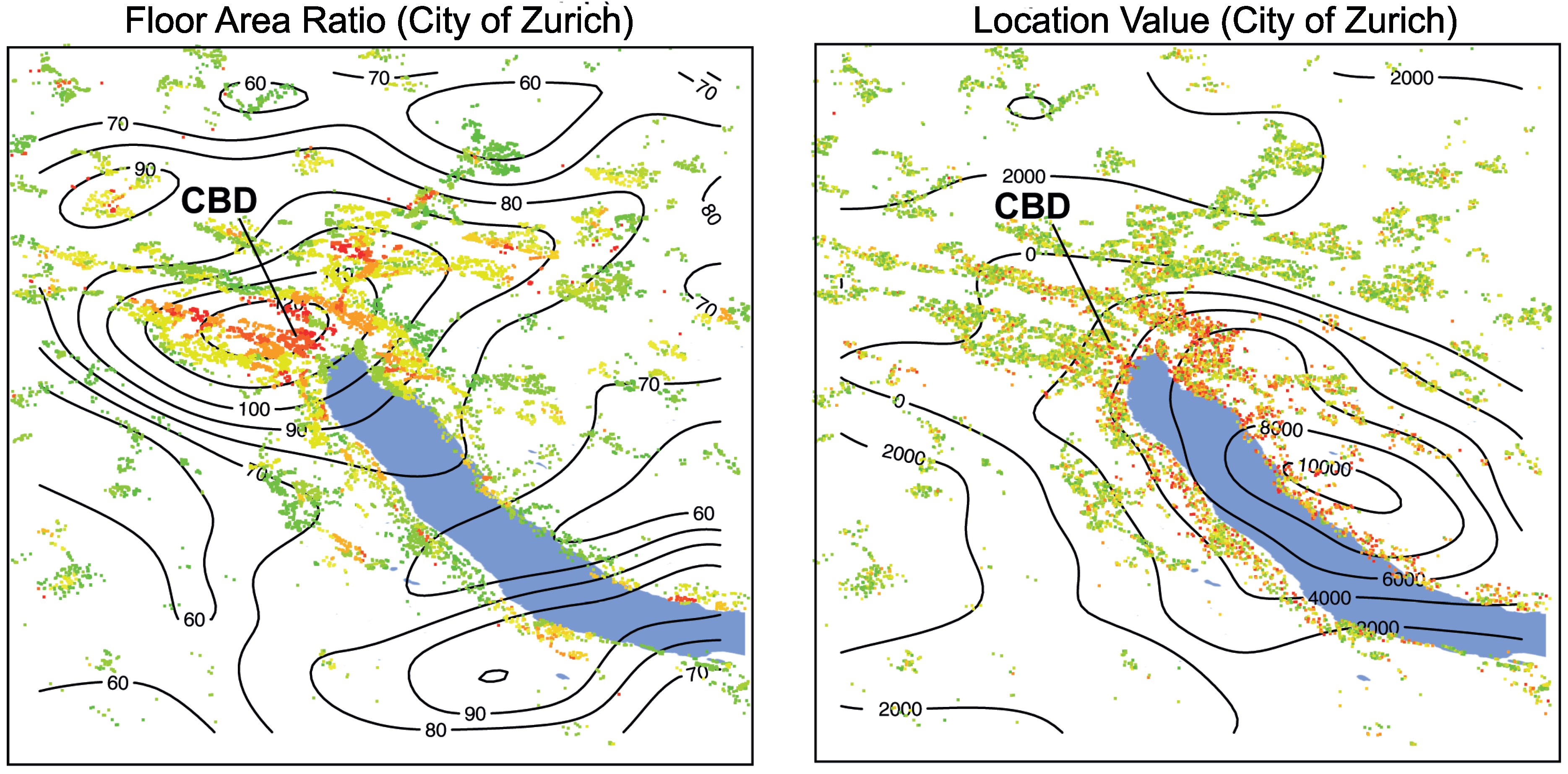

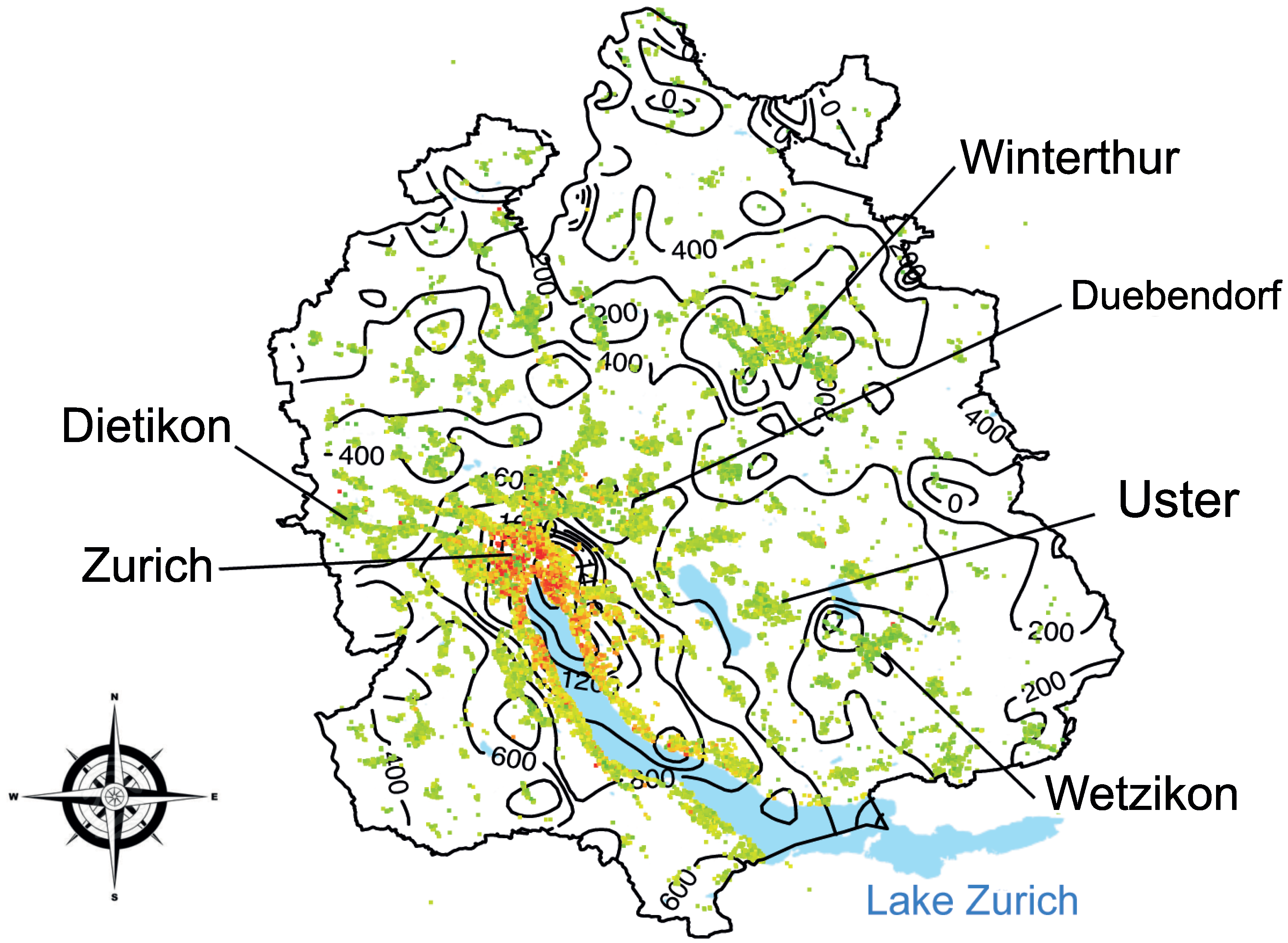

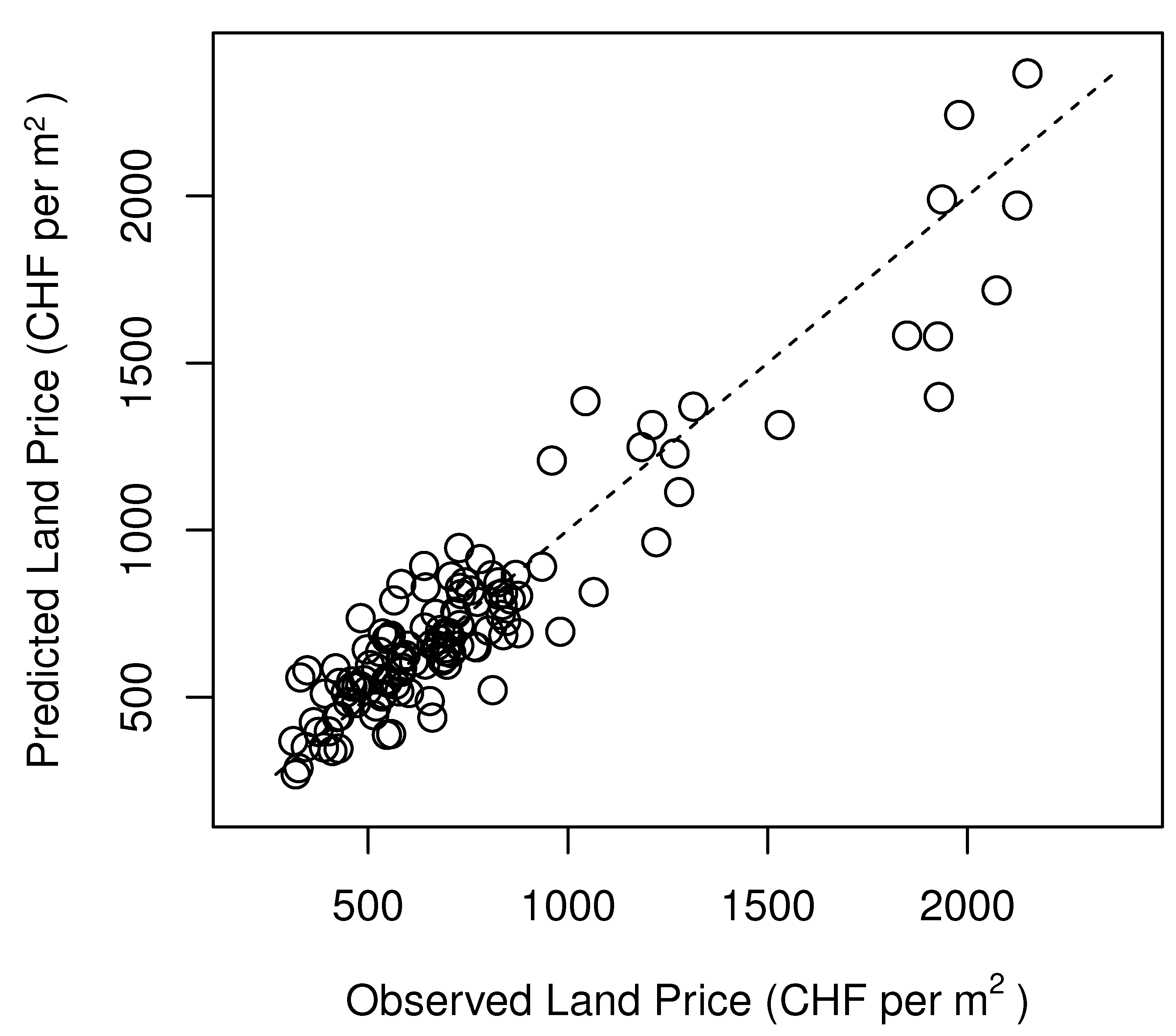

Land Free Full Text Determining Land Values From Residential Rents Html

Land Free Full Text Determining Land Values From Residential Rents Html

4 Steps On How To Calculate Land Value

Does Land Depreciate In Value Accounting Effect Examples

How To Calculate Land Value For Tax Purposes

Straight Line Depreciation Calculator And Definition Retipster

2

Land Free Full Text Determining Land Values From Residential Rents Html

How To Find The Market Value Of Vacant Land Retipster

What Are Land And Buildings Bdc Ca

5 Methods To Calculate Land And Property Value In India

Revaluation Of Fixed Assets Bookkeeping Business Accounting Education Fixed Asset

Does Land Depreciate In Value Accounting Effect Examples